Laurel Mintz | Fabric VC / Elevate My Brand | KNOW Phoenix

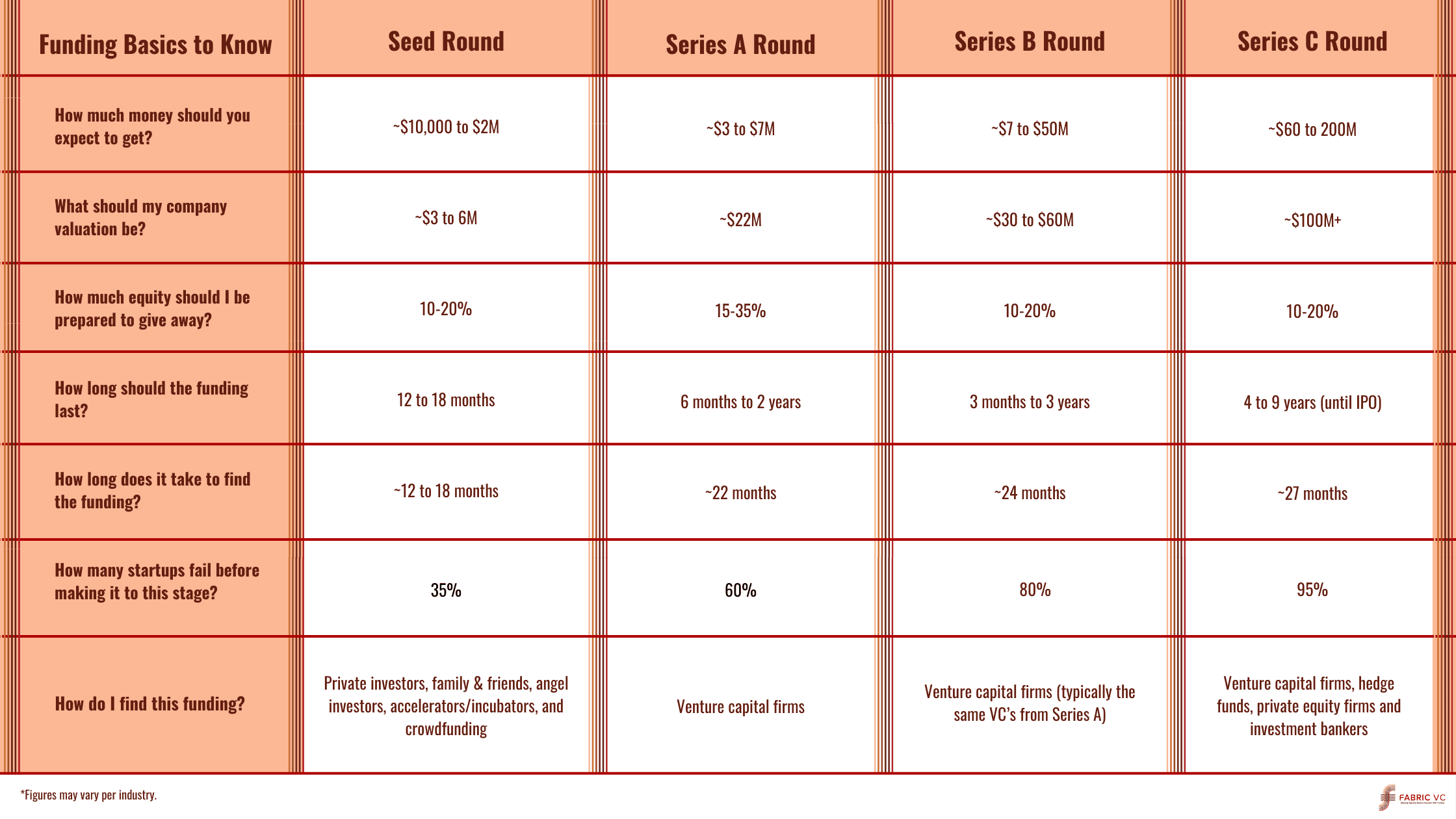

There are a lot of nuances when it comes to fundraising, but whether you’re a funder or a founder, it’s key to understand the basics of each fundraising stage before you get started. Here is everything you need to know about Seed, Series A, Series B and Series C to get your company started on the path toward funding success.

Seed Round

A seed round is typically a company’s starting point for funding and often occurs before the company brings their product or service to market. I like to call this the prototyping or pre-market stage because a seed round helps a business formulate their plans, products and strategies often before they’re ready to launch. This could also be done even earlier in what’s called a pre-seed stage. Think about it this way: a seed is the very first thing you need to grow a garden, so a seed in funding is often the very first institutional sum of money you need to grow your company. The seed might feel small and you might just be scraping by, but when you look back, it’s exactly the kind of funding you needed to take an idea and turn it into a business.

This stage is also critical for you to ensure all of your vendors are solid from legal and accounting to production, distribution and marketing depending on your product or service. An investor wants to see that you’ve holistically thought about most of the players needed to take their seed capital and watch it grow.

Special note: Make sure to take legal and accounting into account early and often in this phase whether with investors or ensuring you’re paying your teams correctly, etc. do not become uninvestable by being a messy startup.

Series A

You should look for Series A funding once you have a fairly strong product market fit and need more growth-focused capital. Series A funds are commonly used to set the stage for a larger or new market launch so you’re likely focusing on refining your business model, marketing, and quality assurance. Series A trades equity for funding which means you’re going to have to give up a percentage of company ownership to your investors. If you’re a true entrepreneur, this is typically a pretty fun, yet stressful stage. It’s easy to feel discouraged in the Series A stage because you’re really excited to share your ideas with the world, but fundraising can, quite frankly, be a pain in the ass. You just have to keep pushing forward.

Special note: don’t get blinded by the dollars. Make sure you’re giving away equity at the right

valuation and building a smart cap table. Not all money is smart money.

Series B

If you make it to Series B, pat yourself on the back, because this signifies that your product or service deserves and has created a foothold in your market. Traditionally, a Series B round helps take a startup to the next level by providing more capital in order to reach more people. At this stage, you’re likely focusing a lot of efforts on marketing and sales or expanding into new markets. Potentially this stage which is growth-focused as well might even be a mergers and acquisition strategy to grow quickly which is why more capital is needed.

Series C

A Series C fund is commonly used to take a startup and turn it into an SMB, SME, or even a Large Enterprise. This round is all about how you can use your funds to grow as fast and as big as possible. Following this stage, you might be looking to sell your company or be acquired, go public with an IPO, or start to reach international markets. Most startups will stop fundraising after receiving their Series C funding, but few may seek additional capital in Series D, E, F, etc…

Special Note: Going into the fundraising journey with an idea of how you’d like to grow and what your end game is i.e. strategic sale or IPO will ensure you’re building your fundraising strategy right from the start. This may evolve over time of course, but charting a course with an end goal in mind will help you get from A-Z that much faster.

Fundraising can be stressful because nothing is set in stone. You might be looking at competitors who are at the same stage with completely different valuations and terms. However, it’s key to know the basics in order to know what your company deserves. So now that you know the fundraising basic stages, it’s time to start fundraising! Here are five actionable next steps to take no matter where you are on your fundraising journey:

-

-

- Connect with your professional network.

- Get some cheerleaders to keep you going.

- Assemble a team of advisors who are experts within your field.

- Use a valuation calculator to understand the true value of your company.

- Contact Fabric VC if you’re a diverse founder looking for Series A funding.

-

And remember, fundraising almost always is longer and harder than anyone can imagine. Don’t get discouraged, make sure you have a strong advisory and/or venture board, and if all else fails, a martini or 2 always helps.

More About Laurel

Laurel Mintz J.D., M.B.A. is the CEO and Founder of award-winning, Los Angeles-based marketing agency Elevate My Brand, serving startups and blue chip global brands like Facebook, Verizon Digital Media Group, PAW Patrol, and Zendesk. Using her experience working with more than 200 companies in the CPG and technology spaces, Laurel launched Fabric VC in 2022 to weave together diverse founders with the funding they need and deserve.